Mark's Musings: Coronavirus

Submitted by Foundation Private Wealth Management on March 2nd, 2020COVID-19 aka Coronavirus

Since cases of the COVID-19 novel coronavirus started making headlines in January 2020, the virus has dominated the global news cycle, more recently filtering into business headlines, creating uncertainty around global growth. This uncertainty is typically an eventual trigger for markets to sell off, which they have in the early part of this week, as fear has crept into investment decisions. That said, time has shown that events like these are not a reason to react and make changes to longer-term investment strategies.

In reviewing where things stand, the good news is that global health authorities are taking the spread of COVID-19 very seriously, coordinating local and global responses to the outbreak. The bad news is that disruption of work (or concern over future disruptions of work) is taking a toll on several industries, especially in the areas that have been most affected by the virus. Tourism and it’s surrounding businesses, like airlines, are obviously one of the areas that are impacted initially. The bigger concern is to global supply chains for products that are produced (or rely on components that are produced) in China where the outbreak initiated.

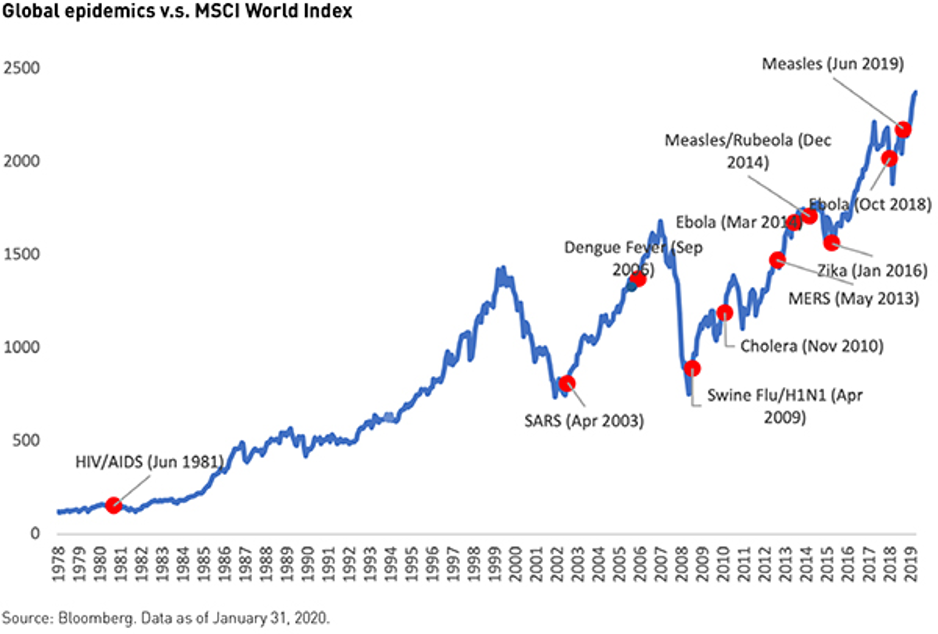

What can we expect? The short answer is that nobody really knows and that is why the markets sold off earlier this week. When reviewing stock markets specifically, and in looking to past events like COVID-19, we know that there is typically an initial selloff in reaction to economic slowdown and unknown factors surrounding medical events. This is typically followed by a rebound in the markets as the medical response tackles the unknowns and implements solutions to the outbreak. We can also expect that governments and central banks will respond accordingly to maintain stimulus and liquidity in the markets as this situation unfolds. Despite the temporary drop in GDP as a result of the disruption, expect that as the situation is resolved, business will be back to full production mode to make up for the shortfalls that occurred during the efforts to contain the virus!

The chart below from Bloomberg highlights the last 4 decades of major outbreaks globally.