Orangecession - Thoughts on the Latest Market Volatility

Submitted by Foundation Private Wealth Management on April 8th, 2025Until last week, Canadians and Mexicans bore the brunt of the U.S. administration’s tariff-first approach. The rest of the world mostly watched in silence—especially us Canadians, as even our sovereignty was challenged by the supposed long time ally. That changed on April 2nd, dubbed “Liberation Day,” when Trump announced new tariffs targeting nations beyond North America. Interestingly, Canada was largely spared from major new tariffs, possibly hinting at what’s to come.

Everyone expected “Liberation Day” to be when the Oval Office dished out global tariffs in retaliation for those imposed on America. Markets rallied in anticipation of a bold but calculated move. But when the flipcharts came out, expectations were far from met. Even longtime Trump supporter, Jim Cramer, voiced disappointment in the President’s approach. You can see his remarks in an interview with Erin Burnett here: https://youtu.be/xLNdq907dfI.

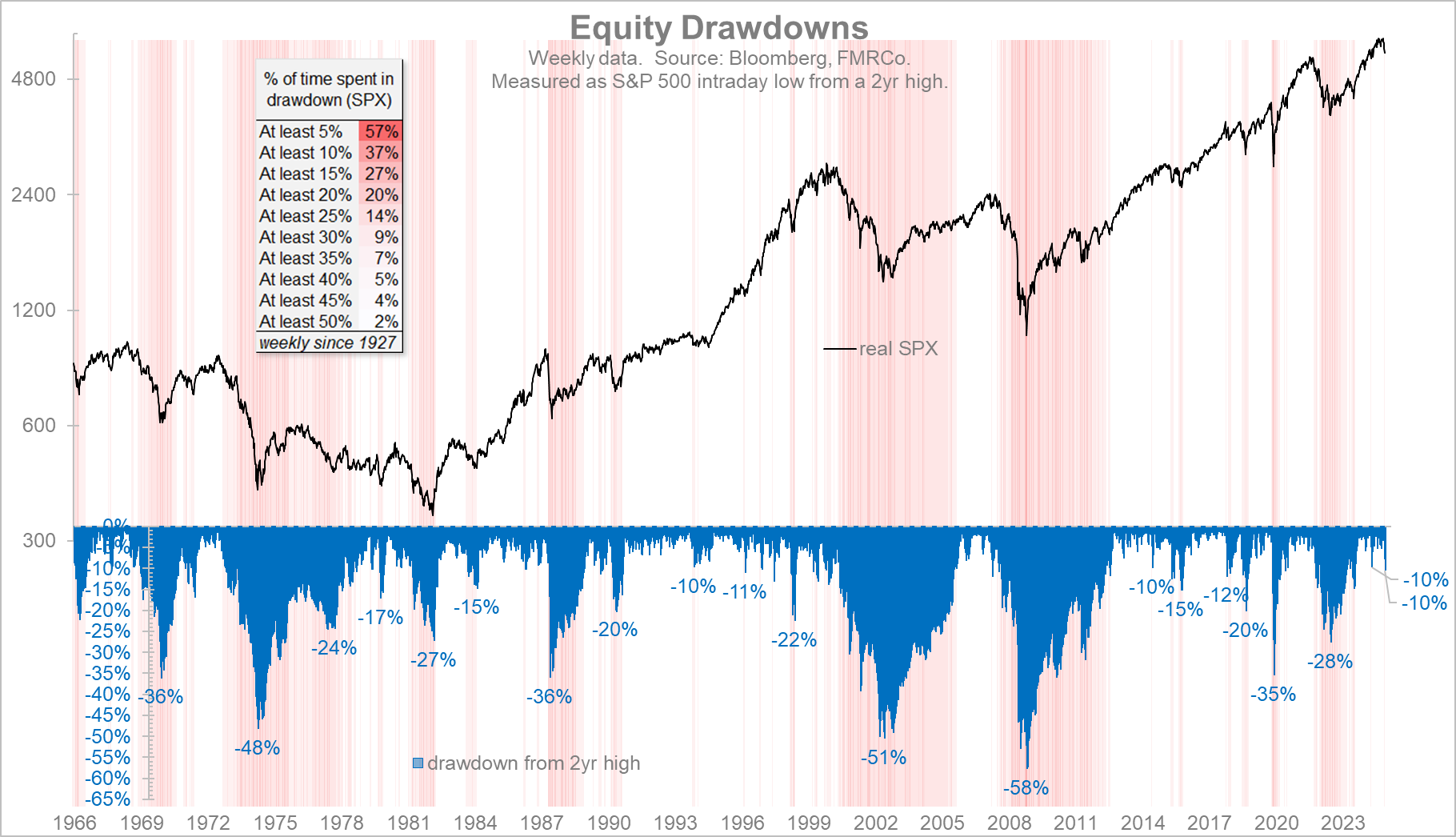

So, what happens now? That’s the $6 trillion question—the amount of market cap erased in just two days. If the pattern with Canada and Mexico repeats, this could be another strategic opening volley. Initially branded as bad-faith trading partners, Canada quickly went from villain to pseudo 51st state, ultimately facing only modest tariffs on goods outside the USMCA framework.

It seems Trump’s “Art of the Deal” playbook is in full effect: launch aggressively, then pivot to negotiating terms favorable to the U.S. If so, we could see a quick recovery as markets adjust back to pre-Liberation Day expectations.

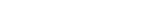

That said, it's important to maintain perspective on what I’ve dubbed the "Orangecession"—not a true recession, but a market shock driven by political maneuvering. Where are we now? Still near historical highs (see S&P 500 chart), coming off one of the most significant shifts in investment dynamics I’ve seen in 20+ years: the end of a 30-year decline in interest rates, reversed to combat inflation spurred by COVID-era stimulus.

Interestingly, even diversification didn’t offer much relief in 2022–2023, as both stocks and bonds declined. This time is different than that, as proper diversification, including select private investments (which we favor), can help weather the Orangecession.

What’s next? While past performance doesn’t guarantee future results, it offers insight. Consider the 1-, 3-, and 5-year returns following the ten largest consecutive two-day drops in S&P 500 history. There are no certainties, but if history is any guide—and if our expectations materialize—we could see a similar recovery trajectory, assuming the markets get a more tactical and moderate approach to these tariff threats.

Crucially, this downturn wasn’t triggered by an unknown virus, a shutdown of the global economy, or untested monetary policy. It’s a political shake-up, and that context makes all the difference.